Table of Content

If you're considering buying a house soon, now is the time to start repairing your credit. Contact us today for a free consultation with one of our credit experts. We can help you get started on the path to credit repair and homeownership.

Credit Saint offers three packages ranging from $79.99 to $119.99 per month. Generating Results - Every 30 days, we are updating your secured client portal with monthly progress reports with your new and improved results. Reduce your high-balance accounts and use credit cards sparingly. Once you know your score and the steps you’re willing to take to repair it, you can then decide on a plan to see how aggressively you should try to improve your score. Though a higher score is always better, most consumers aim to get their credit score into the “good” threshold or above.

Rocket Mortgage

I can’t express enough how NB Credit Repair will make sure you have all the understanding you need when it comes to your credit. Grow your purpose-driven business with confidence and make a great living in the process. Enjoy an all-in-one solution to quickly run, and grow your very own business. Victoria Araj is a Section Editor for Rocket Mortgage and held roles in mortgage banking, public relations and more in her 15+ years with the company.

These services can help you save money by increasing your credit score and improving your credit profile. In some cases, they can even help you get a better rate on your loan. Customers have access to three separate packages and a free consultation to help them find the one that matches their needs. Packages start at $69.95 and go up to $119.95 with a startup fee that’s equivalent to the monthly fee for each service. The big plus to CreditRepair.com’s packages is that each includes credit monitoring, not something all credit repairs boast. Another good option is to consolidate your debts into one monthly payment.

How Much Does Credit Repair Cost?

Call God Speed Credit Repair today and let our experience save you time, money, and frustration. They provided very clear step by step process of the actions they took to increase my credit. My life is now changed for the better thanks to the job well done they did on improving my credit from low 500s to almost 800.

This will show creditors that you can make your payments on time, which will improve your credit score. Many credit repair companies offer a credit restoration program that helps remove negative items from your credit file. This could be just what you need to get approved for a home loan with a lower interest rate. Your credit profile is essential to mortgage lenders because it's one way they can determine whether you're a good candidate for a loan. A higher credit score means you're less of a risk to default on your loan, which could lead to a better interest rate and monthly payments.

Should I fix my credit before buying a house?

If you're thinking about using credit repair services to improve your credit score, it's a good idea to check with the major credit bureaus first. They may be able to provide you with free credit reports and credit counseling services. If you have poor credit but good income, credit repair may be just what you need to get approved for a home loan.

This means customers would pay a monthly fee between $60 to $200, depending on the package, plus a potential setup fee, which can be the same price as a full-month subscription. Some credit repair companies will offer discounts on setup or monthly fees, or both. For example, some companies on this list offer discounts for active military members, veterans and couples. It offers an artificial intelligence -driven personal credit management and repair platform and includes credit monitoring at no additional cost. Other credit repair companies include credit monitoring as an additional service. Customers can avoid a setup fee through Lexington Law and have access to packages starting at $95.95.

How to fix credit fast to buy a house?

Mortgage lenders consider credit history when approving loan applications, and a low credit score can lead to higher interest rates and monthly payments. Outstanding debts, late payments, and timely payments can negatively impact your credit file and credit score. The best credit repair companies can help you resolve negative information or errors on your credit report. When comparing credit repair companies, look for one that is reliable, effective, affordable and that has good customer service. Before you start a credit repair plan, make sure that your low credit score isn’t the result of a mistake.

Mortgage lenders will also consider your income, employment history, and other factors when determining whether to approve you for a loan. All ratings are determined solely by the Forbes Advisor editorial team. We believe in maintaining a positive mindset, creating partnerships with a purpose, and always striving for significant outcomes. When you work with us; you should expect a collaboration with transparency and consistency. I was very scared to allow someone to touch my credit until I spoke with NB Credit Repair. She’s very professional, and answered all my questions in a timely manner.

Another critical step is to make sure you make all of your payments on time. The debt you have includes credit card bills, school loans, and any other kind of debt you may have. The most miniature negative items on your credit file will make you a more attractive candidate to mortgage lenders. So, if you're struggling with credit issues, it's essential to take action and repair your credit score. Our service includes your private assessment, contacting creditors on your behalf, sending documentation back and forth, and more.

Sky Blue Credit has been in operation for over 30 years and offers a unique, one simple credit repair service option. Its service includes everything a customer needs to find and dispute errors on their credit reports and repair their credit scores. Unlike other credit repair companies on this list, there are no upgrades needed to more expensive packages. First, reach out to a local credit repair company to help you dispute any inaccurate information on your credit file. This is the first step in increasing your credit score and improving your credit history. A credit repair program can help remove negative items from your credit report, which will help increase your available credit and improve your credit utilization rate.

Based on the information you have provided, you are eligible to continue your home loan process online with Rocket Mortgage. If you have cards open but you don’t use them, resist the temptation to close them. Closing credit lines lowers your available credit and increases your revolving utilization percentage. Instead, charge a small item – like a cup of coffee or a pizza dinner – once a month and pay your bill off immediately. Let’s review what a credit score is and how you can repair damaged credit to help you successfully buy your dream home. We know that untangling your credit can be both stressful and confusing.

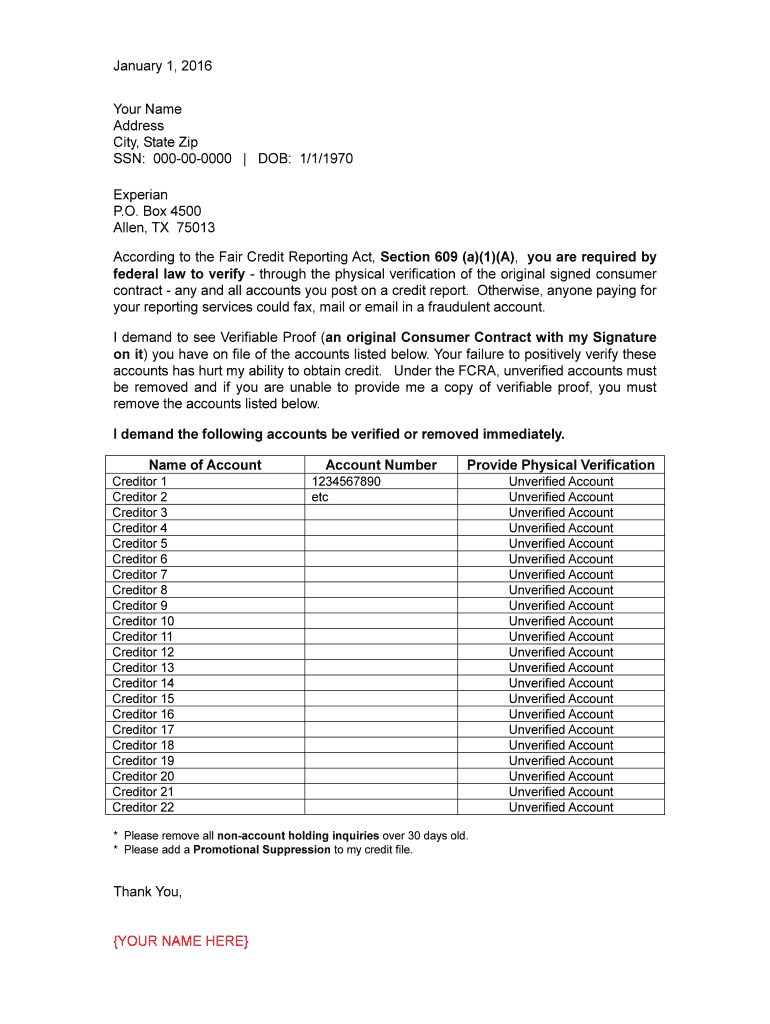

Pull each of your credit reports and carefully check each one for errors. Your credit reports include instructions on error reporting processes. If you do notice something that you believe is an error, your credit bureau must investigate any dispute that you make and report their findings back to you. If the credit bureau finds that what you’ve reported is actually an error, they remove it and raise your score. Our company mission is to offer credit repair and credit repair services to help our clients repair bad credit reports. Our company adheres to a strict privacy policy, and we never share confidential information with any third parties without your written consent.

Will your credit score drop after buying a house?

Some charge a monthly and setup fee while others charge only a monthly fee. If cost is a priority, be sure to evaluate and compare all packages and potential fees. Customers can access Sky Blue Credit’s service for a monthly fee of $79, plus a one-time setup fee of $79. If customers sign up as a couple, the second member receives a 50% discount, which applies to both the monthly and setup fee.

No comments:

Post a Comment